- Home

- Government

- Departments

- Treasurer

- Grand Tower Property Taxes in 2025

Grand Tower Property Taxes in 2025

Why Will Property Taxes be Higher in Grand Tower This Year?

A legal settlement was reached between Grand Tower Energy Corporation and nine local taxing districts regarding the value of the power plant. The settlement covered 10 years of overpaid property taxes.

What Does That Mean for Taxpayers?

Because of the settlement:

- The nine taxing districts had to refund money to the power plant owner.

- Under Illinois law (35 ILCS 200/18-233), those districts are required to recover that lost revenue.

- That recovery happens through a process called recapture, which is applied on this year’s tax bills.

Who Is Affected?

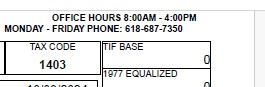

- Property owners in Tax Codes 1401–1404 will see the largest increases.

- If you are not in these codes, any increase on your bill is unrelated to the settlement. In that case, check your exemptions or changes in assessed value.

What’s Causing the Increase?

There are two parts to the increase:

- A small permanent increase due to the power plant’s lower ongoing value.

- A larger temporary increase (recapture) to repay refunded taxes to the nine districts.

If your bill increased by more than 85%, missing exemptions or a higher assessed value could also be contributing.

Who Can I Contact With Questions or Concerns?

For help understanding your property tax bill:

Jackson County Treasurer’s Office

(618) 687-7350

liz.stevenson@jacksoncounty-il.gov

Responsible for billing and collecting taxes—not for setting tax rates, setting the tax amount on bills, changing the amount on bills, or address changes.

For state property tax law concerns:

Your Illinois State Legislators

- Senator Dale Fowler

- Representative Paul Jacobs

For questions about how your local district is using funds:

Contact the Board Members of the specific taxing districts listed on your bill (e.g., schools, fire protection, township).

For county-level oversight or general concerns:

Jackson County Board Members

Note: The County Board is one of the nine districts involved in the settlement, but while they still may hear your concerns, they did not create the state law requiring recapture.

IMPORTANT: Extra Time to Pay if Your Tax Bill Went Up Over 50%If your 2024 property tax bill (due in 2025) increased by more than 50% from last year, you may get 60 extra days to pay for each installment before late fees begin. This extension was approved by the County Board to help with some unusually high tax increases this year. | |

For those who qualify, late fees begin after these dates: First payment late after: November 16, 2025 Second payment late after: January 13, 2026 | Not sure if you qualify? Paying online and seeing late fees? |

Any parcels with a delinquency on December 2, 2025, will incur a $10.00 certified mailing fee, regardless of the tolling of interest. Additionally, payments made after the second installment due date remain subject to being published in the delinquent tax notice, entry of judgement, and exposure to the annual tax sale. | |